In the dynamic real estate market, understanding intricate dynamics through data analytics is crucial. By analyzing trends, demographic shifts, and consumer behavior, professionals anticipate changes in property values, tenant demand, and regulations. This strategic approach enables informed investment decisions, resource allocation, and competitive edge. Staying adaptable, forward-thinking, and continuously learning ensures long-term success in a constantly evolving real estate sector.

In the dynamic realm of real estate, staying ahead of market shifts is paramount for success. This article equips investors with essential tools to forecast trends and strategically budget. By delving into understanding market dynamics and analyzing key trends, readers will gain insights into adapting their strategies for long-term success. Learn how to navigate the ever-changing landscape of real estate and capitalize on emerging opportunities.

Understanding Market Dynamics in Real Estate

The real estate market is a dynamic and ever-changing landscape, influenced by various economic, social, and technological factors. Understanding these market dynamics is crucial for investors and professionals alike to make informed decisions. By keeping a pulse on emerging trends and shifts, one can forecast potential future moves and adapt their strategies accordingly.

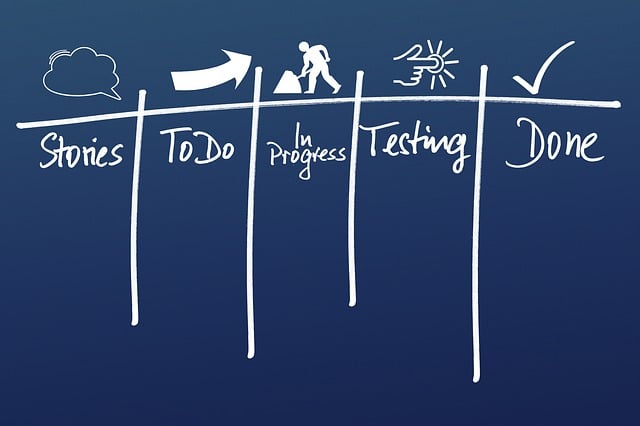

In today’s digital era, data analytics plays a pivotal role in navigating the real estate sector. Accessing and interpreting market data, demographic changes, and consumer behavior patterns enable stakeholders to identify lucrative opportunities and potential risks. Staying informed about these dynamics allows investors to budget effectively, ensuring they are prepared for any shifts that may impact their ventures.

Analyzing Trends for Strategic Budgeting

In the dynamic landscape of real estate, staying ahead of market shifts is paramount for success. Analyzing trends is a powerful tool for strategic budgeting and planning. By examining historical data, market dynamics, and emerging patterns, investors and professionals can anticipate changes in property values, tenant demand, and regulatory environments. This forward-thinking approach enables them to allocate resources effectively, making informed decisions about purchases, developments, or investment strategies.

For instance, tracking demographic trends can help identify areas with high growth potential, guiding budget allocations towards these regions. Additionally, monitoring economic indicators allows for the prediction of rental rates and vacancy levels, aiding in budgeting for operational costs. Real estate professionals who incorporate trend analysis into their budgeting processes gain a competitive edge, ensuring they are prepared to capitalize on market opportunities while mitigating risks.

Adapting to Shifts for Long-Term Success

In the dynamic landscape of real estate, adapting to market shifts is not just a strategy—it’s a necessity for long-term success. Staying ahead involves constantly assessing trends and anticipatory budgeting. This proactive approach enables real estate professionals to navigate changing demands, whether it’s a shift in consumer preferences or economic fluctuations. By allocating resources wisely based on forecast market movements, investors and agents can secure their positions, capitalize on emerging opportunities, and maintain resilience during periods of transition.

Adapting means embracing flexibility in tactics while adhering to fundamental principles. It requires continuous learning and a forward-thinking mindset. For instance, understanding demographic shifts can guide decisions on property development or investment locations. Staying agile allows real estate entities to pivot quickly, ensuring they remain relevant and competitive. Ultimately, adapting to market shifts fosters sustainability, growth, and the ability to weather any storm in the ever-changing real estate sector.