Mastering real estate success involves analyzing historical data, demographic trends, economic indicators, and market shifts. Staying informed enables stakeholders to make strategic decisions regarding investments, developments, and acquisitions. By combining historical analysis with forward-thinking strategies, professionals can predict potential market changes, create agile budgets, and maintain competitiveness during volatility. To optimize investments, regularly review market reports, analyze property data, and diversify portfolios across asset classes, locations, and property types to mitigate risks.

In the dynamic landscape of real estate, staying ahead of market shifts is paramount for investors. This article equips you with essential strategies to forecast trends and budget effectively. We explore ‘Understanding Market Dynamics in Real Estate’, offering insights into unveiling hidden trends and patterns. Subsequently, we present practical steps to adapt and optimize your investments, ensuring success amidst shifting markets. Key focus areas include accurate budgeting techniques tailored to volatile conditions, enabling you to navigate the real estate sector with confidence.

Understanding Market Dynamics in Real Estate: Unveiling Trends and Patterns

In the ever-evolving landscape of real estate, understanding market dynamics is paramount for both investors and professionals. By delving into historical data, demographic shifts, and economic indicators, it becomes possible to unveil trends and patterns that shape the industry. This involves analyzing factors like population growth, employment rates, and housing inventory levels to predict future market movements. For instance, areas experiencing rapid urbanization might witness a surge in demand for residential properties, while changes in interest rates can significantly impact purchasing behaviors. Staying abreast of these dynamics allows stakeholders to make informed decisions regarding property acquisitions, developments, or investment strategies.

Market intelligence in real estate involves recognizing cyclical patterns and understanding the interplay between supply and demand. Foreseeing shifts in market trends enables participants to budget effectively, anticipate price fluctuations, and position themselves advantageously. This proactive approach not only mitigates risks but also presents opportunities for substantial gains. By embracing a data-driven perspective, real estate professionals can navigate the intricate tapestry of market dynamics, ensuring their strategies remain relevant and profitable in an ever-changing environment.

Strategies for Accurate Budgeting Amidst Shifting Markets

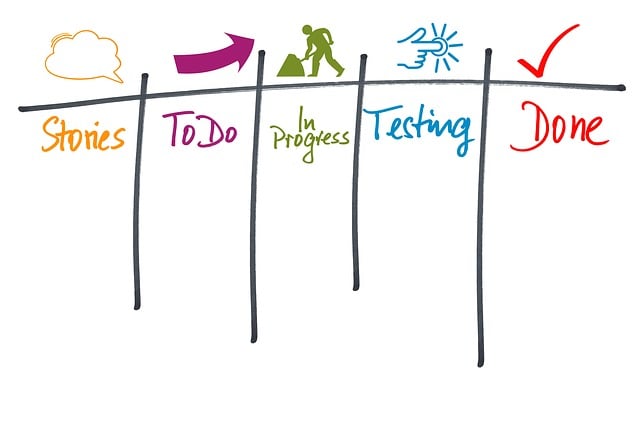

In the dynamic landscape of real estate, where market trends can shift as swiftly as the seasons, accurate budgeting becomes an art. To stay ahead, professionals must adopt agile strategies that factor in both historical data and forward-looking insights. One effective approach is to analyze past performance, identifying patterns and anomalies that could signal future changes. This involves scrutinizing sales figures, rental rates, and demographic shifts over time, allowing for informed predictions about potential market fluctuations.

Additionally, staying attuned to industry news and regulatory changes is paramount. Keeping abreast of government initiatives, interest rate trends, and technological advancements can provide valuable clues about upcoming shifts. By combining these qualitative and quantitative methods, real estate experts can craft budgets that are not just reactive but proactive, ensuring they remain competitive and profitable even amidst market volatility.

Practical Steps to Adapt and Optimize Your Real Estate Investments

To adapt and optimize your real estate investments in the face of market shifts, start by staying informed about industry trends and economic indicators. Regularly review market reports and analyze data on property values, occupancy rates, and rental income to anticipate changes. This proactive approach allows you to make data-driven decisions.

Next, diversify your portfolio to mitigate risks. Spread investments across different asset classes, geographic locations, and property types. For instance, consider a mix of residential, commercial, and industrial properties. Diversification ensures that unexpected downturns in one segment don’t significantly impact your overall real estate portfolio.