In a dynamic real estate market, success demands adaptability. This involves a multi-faceted approach: understanding market dynamics through data analytics and industry insights, staying informed about economic shifts, demographic trends, and global events, and flexibly budgeting to capitalize on new opportunities. By leveraging strategic cost management, building financial reserves, and regularly reviewing budgets, investors can ensure short-term stability while navigating market changes for long-term growth. Continuous analysis, diversification, and portfolio optimization are key to thriving in the ever-changing real estate landscape.

In today’s dynamic real estate market, forecasting shifts and budgeting accordingly are paramount for success. This article equips investors with essential tools to navigate changing trends and drivers. By delving into understanding market dynamics, implementing effective budgeting strategies, and adopting practical adaptation steps, you can optimize your real estate investments despite uncertainty. Discover actionable insights tailored to help you thrive in a constantly evolving landscape.

Understanding Market Dynamics in Real Estate: Identify Trends and Drivers

In the dynamic world of real estate, staying ahead of market shifts is paramount for investors and professionals alike. Understanding market dynamics involves a deep dive into identifying trends and drivers that influence property values, demand, and supply. By keeping an eye on economic indicators, demographic changes, and emerging technologies, stakeholders can anticipate shifts well in advance. For instance, rising population density might drive up demand for urban properties, while remote work trends could impact the commercial real estate landscape.

Real estate professionals must be adept at navigating these changes, leveraging data analytics to forecast market movements. Staying informed about regulatory reforms, interest rates, and global events is essential as they can significantly alter investment strategies. By identifying key drivers, investors can make informed decisions, whether it’s timing their entries or exits or diversifying their portfolios to mitigate risks associated with unpredictable market shifts in real estate.

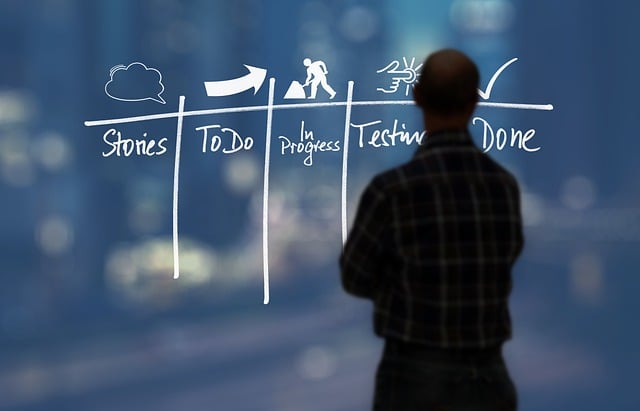

Strategies for Effective Budgeting Amidst Shifting Markets

In the ever-evolving landscape of real estate, staying agile with budgeting is paramount. When market shifts occur, whether due to economic fluctuations or changing consumer behaviors, a dynamic budget becomes an indispensable tool for success. One effective strategy is to implement a flexible budgeting approach, allowing for adjustments as new trends emerge. This involves regular market analysis and close monitoring of key performance indicators specific to the real estate sector. By setting aside dedicated funds for adaptable expenses—such as marketing campaigns targeting new demographics or investments in innovative sales technologies—agents and developers can swiftly capitalize on emerging opportunities.

Additionally, building a robust financial reserve provides a safety net during uncertain times. This strategic move enables businesses to weather short-term market shifts without compromising long-term growth. Efficient cost management is another critical aspect; by negotiating with vendors, optimizing office space, and leveraging digital tools for streamlined operations, real estate professionals can significantly reduce overheads without sacrificing quality. Regular budget reviews and collaborative decision-making within teams foster a culture of financial accountability, ensuring everyone remains aligned with the shifting market dynamics.

Practical Steps to Adapt and Optimize Your Real Estate Investments

Staying ahead of market shifts is crucial for real estate investors to maximize returns and minimize risks. The first step involves continuous market analysis, keeping a close eye on economic indicators, demographic trends, and local dynamics that influence property values. Engaging with industry experts, attending seminars, and subscribing to reliable data sources can provide valuable insights.

Once you’ve gathered relevant information, the next practical step is reevaluating your investment portfolio. Identify properties that may be affected by upcoming changes and consider strategies such as diversifying your investments across different asset classes, regions, or property types. Optimizing your budget by allocating resources efficiently will ensure you’re well-positioned to capitalize on emerging opportunities while navigating potential challenges in the real estate market.