In the dynamic real estate market, staying ahead through data analysis and strategic budgeting is crucial for success. By monitoring economic indicators, demographic shifts, and regulatory changes, professionals predict market movements and make informed decisions regarding supply, demand, and resource allocation. Advanced tools enable accurate forecasting, ensuring resilience during fluctuations, while identifying trends in consumer behavior, regulatory updates, and economic shifts, such as remote work's impact on suburban areas. This proactive approach maximizes financial prospects by future-proofing properties and adapting to evolving preferences for sustainable and smart homes.

In the dynamic realm of real estate, forecasting market shifts is key to staying ahead. This article guides you through the essential steps of understanding intricate market dynamics, leveraging data analysis to identify emerging trends, and strategically adjusting budgets for future proofing. By embracing these tactics, you’ll enhance your ability to navigate the competitive landscape and capitalize on opportunities in an ever-evolving real estate market.

Understanding Market Dynamics in Real Estate

In the ever-evolving landscape of real estate, staying ahead of market shifts is paramount for investors and professionals alike. Understanding market dynamics involves keeping a close eye on various factors such as economic indicators, demographic trends, and regulatory changes. By monitoring these elements, stakeholders can anticipate shifts in demand, pricing pressures, and consumer behavior. This proactive approach allows them to make informed decisions when budgeting and allocating resources.

Real estate markets are intricate tapestries woven with threads of supply and demand, influenced by local and global forces. Navigating these complexities requires a deep understanding of the market’s rhythm—when to buy low, sell high, or hold steady. In today’s digital era, accessing real-time data and analyzing historical trends empowers players in the real estate sector to forecast shifts with greater accuracy. This, in turn, facilitates strategic budgeting and ensures resilience amidst changing economic climates.

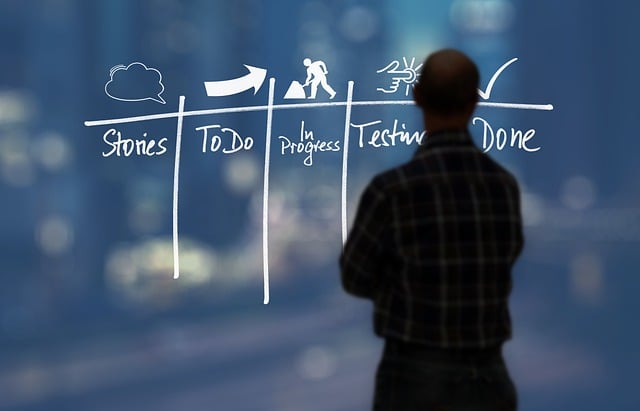

Identifying Shifts Through Data Analysis

In the dynamic world of real estate, staying ahead of market shifts is paramount for success. Identifying these shifts begins with a deep dive into data analysis. By leveraging advanced analytics tools and historical trends, professionals can predict changes in property demand, pricing dynamics, and even neighborhood developments. This data-driven approach allows agents, investors, and developers to make informed decisions, ensuring they’re prepared for upcoming market transformations.

Through comprehensive data analysis, patterns emerge that signal shifting consumer preferences, regulatory changes, and economic indicators. For instance, a surge in remote work trends might lead to a demand shift towards suburban areas offering more spacious living, while urban centers may experience a temporary dip in property values. Staying attuned to these signals enables stakeholders in the real estate sector to budget effectively, adjust marketing strategies, and capitalize on emerging opportunities.

Strategically Adjusting Budgets for Future Proofing

In today’s dynamic real estate market, strategically adjusting budgets is more crucial than ever for future proofing. By closely monitoring emerging trends and analyzing historical data, property investors can anticipate shifts in demand, pricing pressures, and regulatory changes. This proactive approach allows them to make informed decisions about allocating financial resources efficiently. For instance, identifying growing preferences for sustainable and smart homes might prompt a budget reallocation towards eco-friendly renovation projects or investments in innovative home automation technologies.

Future-proofing involves not only adapting to market shifts but also staying ahead of the curve. Investing in areas with potential long-term growth, such as urban revitalization zones or regions with improving infrastructure, can provide significant returns. Conversely, budgeting for potential risks, like changing interest rates or economic downturns, ensures investors maintain flexibility and resilience. This strategic budget adjustments foster adaptability, enabling real estate professionals to navigate the ever-changing landscape and maximize their financial prospects.